Manufacturers Plan to Pass Tariff Costs on to Their Customers

KEY POINTS

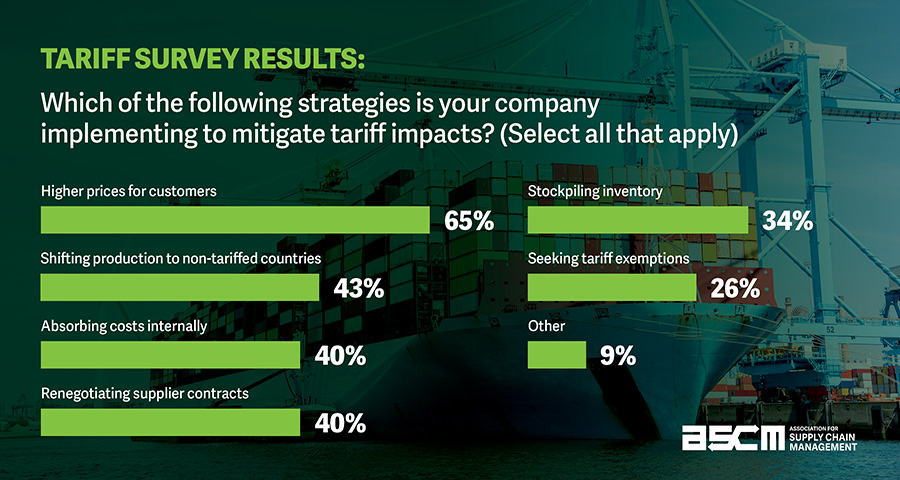

- Most manufacturers surveyed by ASCM plan to pass tariff costs to their customers

- Health systems use SRS to calculate tariff exposure for the items they buy.

ASCM survey notes that 65% of manufacturers surveyed intend to pass increased tariff costs on to their customers.

An ASCM survey of 400 supply chain professionals reveals that 65% of manufacturing organizations intend to pass increased costs on to customers. Of those, 41% expect moderate price hikes, 20% foresee significant increases, and 3% predict extreme markups.

To adapt, many manufacturers are adjusting their strategies. The survey noted 43% shifting production to non-tariffed countries, 40% attempting to absorb the costs or renegotiate supplier contracts, and 34% stockpiling inventory in anticipation of further disruption.

Healthcare executives face challenges estimating their exposure to increased costs from tariffs for their health system. There is no one-size-fits-all answer. Any health system can set up a 30-minute SRS training session on how leading health systems assess their exposure to tariffs and other risks, and the steps they take to mitigate risks proactively. Simply email SRS Support (support@supplyrisk.com) to schedule a time.

Here is a cumulative list of current and planned tariffs:

- 20% tariff on Chinese goods since March 4, 2025.

- 25% tariff on all imports from Canada and Mexico starting April 2, except for a 10% tariff on Canadian energy products.

- 25% tariff on all steel and aluminum imports into the United States. A copper investigation was announced on February 27, 2025 focusing on tariffs to address competition from China, Chile, Canada, Mexico, and others.

- 25% tariffs on cars, semiconductors, and pharmaceutical products; duties on drugs and chips to increase throughout 2025.

- The Biden Administration’s Section 301 tariffs on syringes, needles, respirators, gloves, and facemasks with tariffs increasing in three phases: September 27, 2024; January 1, 2025; and January 1, 2026.

The following SRS reports can be tailored to the items you buy to assess tariff exposure for your health system:

- “Products Tariffs – Special Report” – details suppliers sourcing from tariffed countries (in the Prevent dashboard).

- “Products by Country (Tariff Risk)” – choose any country to see which items you buy are manufactured there (in the Prevent dashboard).

- “Products Subject to Section 301 China Tariffs” – downloads current section 301 tariffs on healthcare item made in China (in the Prevent dashboard).

- “Products Sites and Risks” – lists manufacturing location for all items you buy from the supplier (in the Prevent dashboard after you drill down on a supplier).

- “Supplier Geopolitical Summary” – summarizes exposure for all countries (in the Respond dashboard).

If you have not yet tailored SRS for the items you buy, it’s easy to do so with an SRS subscription.

For more information, see:

Association of Supply Chain Management, Relentless Tariffs and a Supply Chain Crossroads, March 28

Manufacturing.Net, Survey Uncovers Tariff Impact on Manufacturers and Their Adjustment Strategies, March 12

Supply Risk Solutions, Impact of Upcoming Tariffs on Healthcare Sourcing, March 11

Supply Risk Solutions, Trump’s Partial Tariff Exemptions Leave Majority of Canada-Mexico Duties in Place, March 7

Supply Risk Solutions, U.S. Tariffs on Canada and Mexico Take Effect, March 4

Supply Risk Solutions, U.S. Unveils New Tariff Plans, February 28

Supply Risk Solutions, Trump Confirms Canada and Mexico Tariffs Will Take Effect on March 4, February 25

Supply Risk Solutions, Trump Proposes 25% Tariffs on Cars, Chips, Pharma Products, February 20

Supply Risk Solutions, China Counters U.S. Tariffs with Targeted Tariffs, Export Controls, and Investigations, February 4

Supply Risk Solutions, Trump Delays Tariffs on Mexico and Canada, February 3

Supply Risk Solutions, U.S. to Impose Tariffs on Key Trading Partners Feb. 1, February 1

Supply Risk Solutions, Trump’s Tariff Policies Spark Global Uncertainty, January 27

Supply Risk Solutions, Trump Proposes 25% Tariffs on Canada and Mexico Starting February 1, January 21

Supply Risk Solutions, Tariff Planning Requires Product Transparency, January 13

Supply Risk Solutions, U.S. Tariff Plans Bring Urgency to Knowing Product Manufacturing Locations, December 2

Supply Risk Solutions, Tariffs Push Manufacturers to Rethink Supply Chain Strategies, November 15

Supply Risk Solutions, Tariffs Spur Urgency to Understand Product Manufacturing Locations, November 11

Supply Risk Solutions, List the Products You Buy That Are Subject to China Import Tariffs, October 28

White & Case, United States Finalizes Section 301 Tariff Increases on Imports from China, September 17